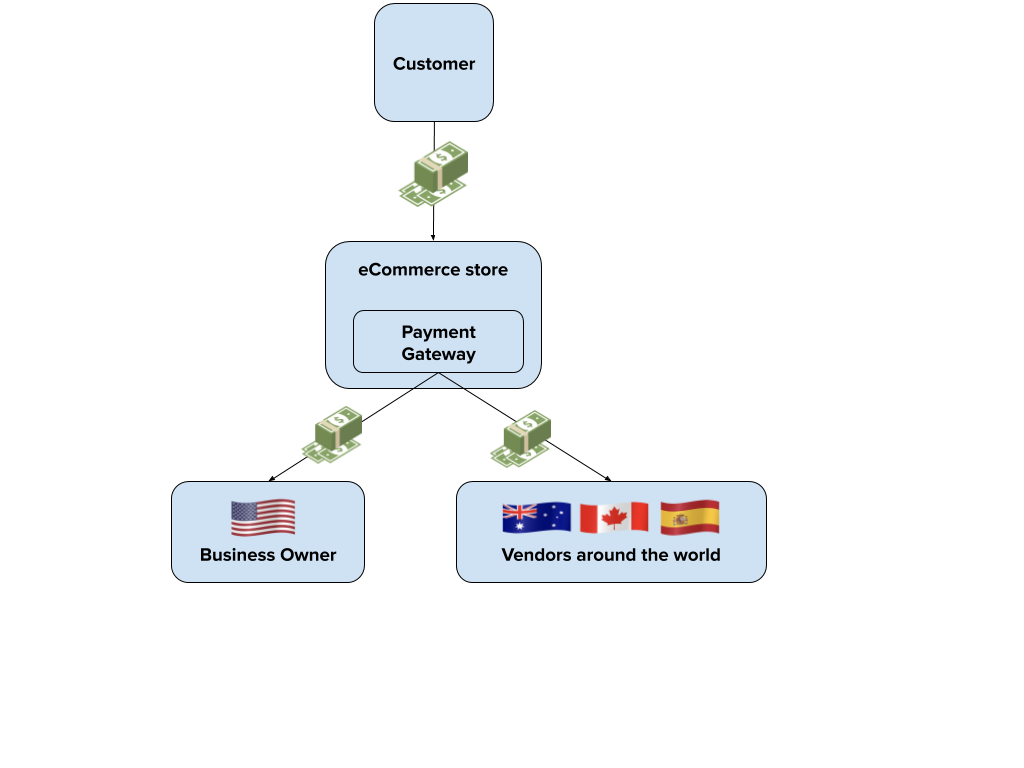

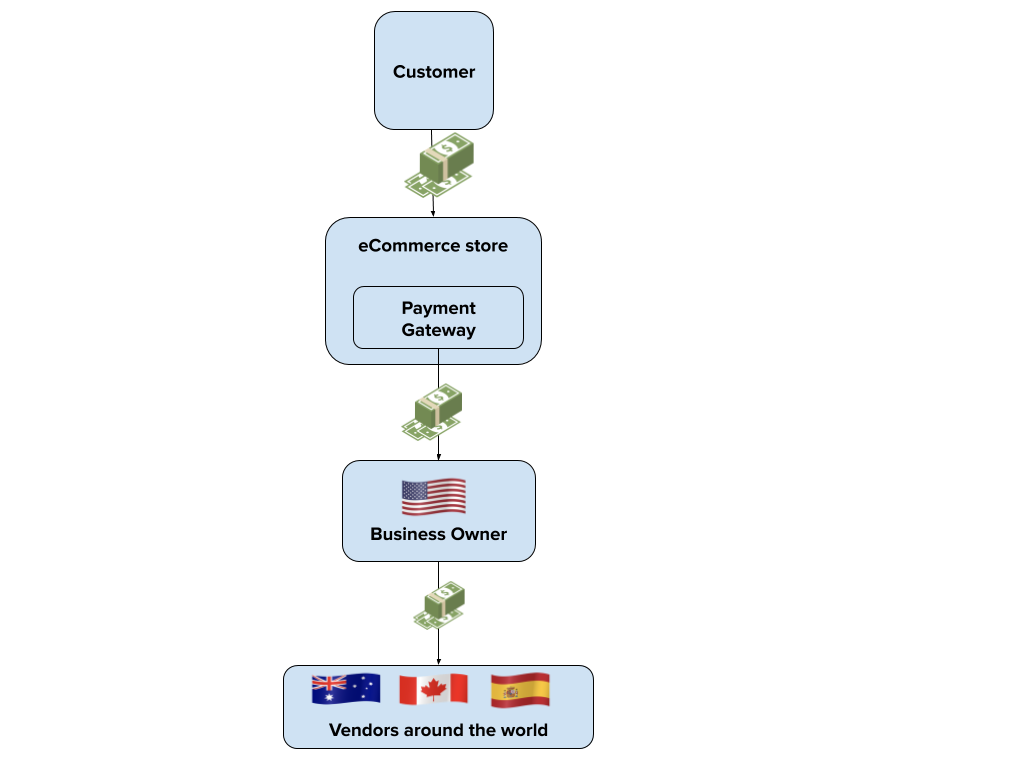

Businesses with multiple vendors (registered in different countries across the globe) may suffer from double-taxation when the money is distributed. For instance, if you, the business owner, collect all the amount paid by the customer on your end first and later disperse it to your vendors, you might be paying taxes a couple of times, first in your country, and then in your vendor’s country.

With technology, however, if you split the received payment at the right time, you can reduce the amount paid in taxes. Doesn’t make sense? This is what we are talking about.